Thinking of investing in Liverpool?

Liverpool’s economic landscape presents a compelling narrative of growth, innovation, and digital transformation. According to Liverpool City Council’s latest economic indicators, the city boasts a £18.4 billion GDP with 294,788 employed individuals, while official employment statistics show remarkable 10.61% growth.

The convergence of traditional industries with cutting-edge digital sectors creates unprecedented opportunities for businesses. This is particularly relevant for those seeking to leverage search engine optimisation strategies to capture market share in this thriving ecosystem.

| Key Economic Indicators | Value | Source |

|---|---|---|

| GDP Total | £18.4 billion | Liverpool City Council |

| GDP per Head | £40,392 | ONS Census 2021 |

| Active Businesses | 17,985 | Liverpool City Council |

| Employment Growth Rate | 10.61% | Liverpool City Region |

| Population | 508,961 | ONS Census 2021 |

Liverpool City Council’s comprehensive business data reveals a remarkable economic foundation with 17,985 active businesses. This generates a business density of 431 per 10,000 residents, indicating a vibrant entrepreneurial environment.

The Office for National Statistics Census 2021 data shows a GDP per head of £40,392, positioning Liverpool competitively within the UK market. Demographic analysis reveals 9.3% population growth over the past decade, signalling sustained expansion that supports business development.

Employment statistics from Liverpool City Region authorities demonstrate particularly strong momentum. Current employment stands at 294,788 individuals with 10.61% employment growth significantly outpacing national averages. This labour market expansion creates a robust consumer base and indicates healthy economic fundamentals that support business investment.

Liverpool Chamber of Commerce research identifies the Professional Business Services (PBS) sector as the city’s economic powerhouse. This sector generates an estimated £36.98 billion in turnover through 12,545 companies.

Analysis from the Chamber’s latest sectoral studies shows this encompasses legal, accounting, consulting, advertising, and management services. These represent a critical component of the city’s economic infrastructure.

| Business Sector | Number of Companies | Annual Turnover/GVA |

|---|---|---|

| Professional Business Services | 12,545 | £36.98 billion |

| Wholesale \& Retail Trade | 5,451 | N/A |

| Construction | 4,480 | N/A |

| Digital \& Creative | 6,500+ | 52% growth |

| FinTech Companies | 42 | £218.6 million |

The Liverpool City Region Plan for Prosperity Evidence Base demonstrates that the sector’s significance extends beyond direct economic contribution. It provides essential support services that enable growth across other key industries including life sciences, advanced manufacturing, and creative digital sectors.

Chamber of Commerce investment analysis indicates that targeted investment of £1.6 million annually over five years in the PBS sector could yield remarkable returns. Projections show £480,000 for every pound spent, whilst potentially creating between 1,000 and 1,500 new jobs.

UK Data Company’s analysis of Liverpool’s business ecosystem reveals healthy diversification across sectors. Official business registration data shows wholesale and retail trade leading with 5,451 companies. Construction follows with 4,480 companies, and professional activities with 4,444 companies.

This distribution indicates a balanced economy capable of weathering sector-specific downturns whilst maintaining overall stability. The British Chambers of Commerce Quarterly Economic Survey reveals mixed conditions within different sectors.

The manufacturing and production sector shows challenges, with 27% of firms experiencing declining sales. Conversely, marketing, media, and advertising businesses demonstrate strong performance with 42% reporting increased sales. This reflects the growing importance of digital services and creative industries.

Liverpool property market analysis from leading estate agents shows steady growth with strategic implications for business location decisions. Blue Row Homes’ comprehensive market research indicates the average house price stands at £186,000 as of September 2024. This represents a 1.3% annual increase.

RW Invest property market reports suggest this growth appears modest compared to the North West’s 4.8% rise. However, it reflects market stability and affordability that attracts businesses and workers alike.

Property investment specialists at Investropa forecast significant acceleration. They project 20% price increases between 2023 and 2025.

| Property Metric | Current Value | Market Outlook |

|---|---|---|

| Average House Price (2024) | £186,000 | Stable |

| Annual Price Growth | 1.3% | Moderate |

| Price Forecast (2023-2025) | +20% | Strong Growth |

| Average Monthly Rent | £801 | Rising |

| Annual Rental Growth | 8.4% | Strong Growth |

| Office Space Transactions 2024 | 318,479 sq ft | Expanding |

This growth trajectory, according to Liverpool City Region development plans, is driven by substantial infrastructure investments. These include the £5.5 billion Liverpool Waters development and extensive regeneration projects attracting over £550 million in private investment.

Fisher German property consultancy reports demonstrate robust commercial sector performance. They record 318,479 square feet of office space transacted in 2024, representing a 12.5% increase from the previous year.

This growth, according to Insider Media’s commercial property analysis, indicates strong demand for commercial space. It demonstrates business confidence in Liverpool as a location for expansion and new ventures.

However, market analysis from commercial property specialists reveals constraints in premium office availability. Fisher German industry experts note that “a lack of high-quality office space is expected to limit large-scale transactions.” This supply constraint supports rental growth and presents opportunities for property developers whilst potentially challenging businesses seeking Grade A accommodation.

Blue Row Homes’ private rental market research demonstrates strong momentum. Average monthly rents reach £801 in October 2024, marking an 8.4% annual increase.

Their comprehensive five-year analysis shows even more dramatic growth. Rents increased from £757 in 2020 to £1,028 in 2025, representing a 35% rise that mirrors national patterns according to industry benchmarking.

Liverpool property agents’ market reports indicate supply constraints continue to drive rental growth. The market experiences 25% below pre-pandemic availability levels nationally. Local letting agents consistently report strong tenant demand despite the frenzy of 2022-2023 calming somewhat, with low vacancy rates persisting across the city according to City Residential’s latest market surveys.

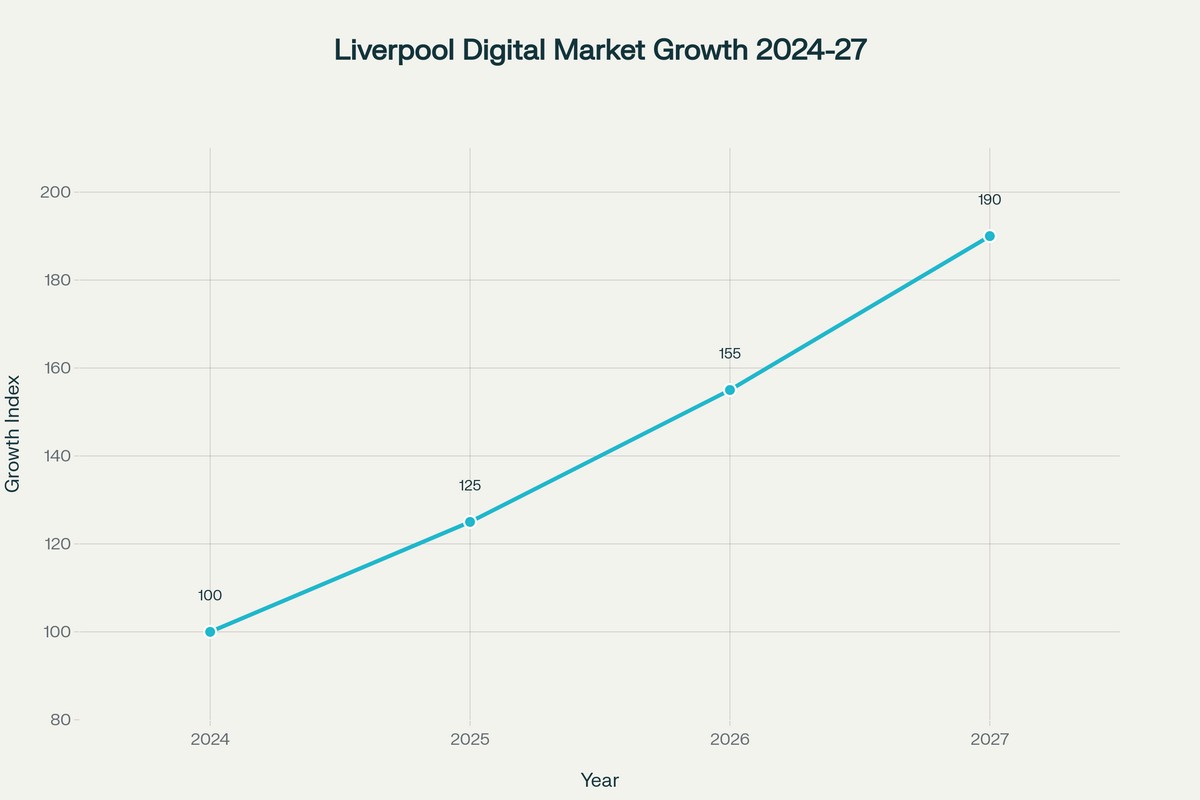

Liverpool City Region’s digital strategy documents reveal the city’s digital and creative sectors as the most dynamic growth area. Official statistics show 52% GVA growth – the second largest among northern cities according to regional competitiveness analysis.

Liverpool John Moores University’s scale-up ecosystem research shows this expansion encompasses 6,500 digital and creative companies. These employ over 51,000 professionals, including 20,000 freelancers, creating a vibrant ecosystem that supports innovation and entrepreneurship.

Tech industry analysis from Invest Liverpool demonstrates remarkable sector resilience and ambition. 79% of Tech Climbers businesses seek funding and over 240 jobs are projected for growth according to their latest sector review.

This expansion benefits from substantial infrastructure investment. Liverpool City Region’s connectivity strategy documents a 212km full-fibre, gigabit-capable network that provides the technological foundation for digital business growth.

White Cap Consulting’s Liverpool City Region FinTech Ecosystem Report 2023 reveals significant sector development. The FinTech sector generates an estimated £218.6 million of GVA annually, supported by 42 dedicated FinTech firms. 79% of these are startups and scaleups.

The report identifies key strengths in payments, WealthTech, accounting, and InsurTech. Notable successes include CIRCA5000 (formerly tickr), which has raised over £12 million in funding and achieved national recognition.

According to Growth Platform analysis, the sector benefits from Liverpool’s long legacy of financial services. This particularly applies to wealth management, combined with strong applied tech capabilities in artificial intelligence, big data, and data analytics emerging from local universities.

Major financial services brands maintain significant operations in the region. These include Investec, Rathbones, RSA, Barclays, Santander, and The Very Group, as documented in the FinTech ecosystem mapping.

Liverpool City Region development plans detail 107 innovation assets and projects supporting the city’s innovation ecosystem. Government investment zone documentation shows Liverpool’s designation as one of 12 new UK Investment Zones.

Free port status provides additional incentives for business investment and development according to policy announcements. The Hartree National Centre for Digital Innovation at Sci-Tech Daresbury houses advanced computing, data, and AI technologies.

This facility maintains partnerships including IBM Research, Atos, and Intel, according to facility documentation. It provides businesses with access to cutting-edge technology and expertise that supports innovation and competitive advantage.

Investment targets outlined in Liverpool City Region’s prosperity plan are ambitious. They aim for 5% R\&D investment annually by 2030 – nearly double the national target. This investment strategy, according to economic impact assessments, aims to provide £41.7 billion gross GVA benefit and 44,000 new jobs by 2030.

Liverpool’s digital marketing landscape analysis reveals significant SEO opportunities driven by the city’s business growth and digital transformation. Liverpool City Council data shows 17,985 active businesses and regional statistics indicate 24,790 SMEs in the wider area. The potential client base for SEO services is substantial.

Market research from digital marketing agencies suggests over 20 established SEO agencies serve the market. This creates a competitive but opportunity-rich environment for specialist providers.

| SEO Market Segment | Market Size | SEO Opportunity Level |

|---|---|---|

| Professional Services | 12,545 companies | Very High |

| Property \& Real Estate | 20% growth forecast | Very High |

| Healthcare \& Life Sciences | Investment Zone focus | High |

| E-commerce \& Retail | 5,451 companies | High |

| FinTech \& Financial Services | 42 + major brands | High |

Digital marketing industry analysis demonstrates that local search dominance has become critical for Liverpool businesses. Mobile usage studies indicate over 80% of searches occur on mobile devices.

This shift necessitates mobile-first SEO strategies and local optimisation addressing specific geographic targeting. Coverage areas include Liverpool and surrounding regions such as Wirral, Chester, Southport, and Wrexham, according to local SEO specialists.

Liverpool Chamber of Commerce data showing the Professional Business Services sector generates £36.98 billion in turnover represents a particularly lucrative target market for SEO services. These businesses – including legal firms, accountancy practices, consultancy services, and marketing agencies – require sophisticated digital marketing strategies to compete effectively in Liverpool’s business landscape.

Liverpool Market Intelligence Dashboard – Economic indicators, business growth, and digital sector performance with SEO market insights

Local Liverpool SEO experts such as myself, consistently emphasise that Google Business Profile optimisation has become essential. Freedom Search notes that businesses without proper GMB setup “may not appear in Google Maps when users search for businesses in the Liverpool area.” This creates consistent demand for local SEO services across all business sectors.

Liverpool SEO market analysis demonstrates healthy competition with agencies ranging from local specialists to national players. Established providers include JDR Group (established 2004), Luva Marketing, Vindicta Digital, and Coolmedia Marketing.

These serve diverse client bases from sole traders to multinational organisations according to agency portfolio analysis. Digital marketing consultancy research reveals price competition ranging from moderate to high, with service quality varying significantly across providers.

This variation creates opportunities for agencies that can demonstrate clear ROI and maintain transparent reporting practices according to industry benchmarking studies. Technical SEO expertise emerges as particularly high-demand according to agency specialisation analysis.

Businesses require Core Web Vitals optimisation, mobile-first design, and voice search optimisation to compete effectively. The integration of AI-driven SEO strategies is becoming increasingly important as businesses seek competitive advantages through automation and advanced analytics, according to Liverpool digital marketing trend analysis.

Healthcare and life sciences companies present substantial opportunities. Liverpool’s Investment Zone designation in life sciences drives sector growth according to government development plans. These businesses require specialised SEO strategies that address regulatory compliance whilst maximising visibility for specialised services.

The property and real estate sector, with investment forecasts showing 20% growth by 2025, requires SEO services that capitalise on high-value search terms and local market expertise. Estate agents, property developers, and letting agencies need sophisticated strategies to compete for valuable commercial and residential property searches according to property marketing analysis.

Tourism and hospitality businesses benefit from Liverpool’s cultural destination status. They require SEO strategies that capture both local and visitor search intent according to tourism industry research. The city’s rich cultural heritage, including Beatles tourism and waterfront attractions, creates unique optimisation opportunities documented in visitor economy studies.

E-commerce and retail businesses face increasing competition from both local and national providers. They require comprehensive SEO strategies including product page optimisation, local inventory searches, and multi-channel marketing integration according to retail digital marketing analysis.

Legal firms in Liverpool face intense competition for high-value search terms such as “Liverpool solicitor” and “personal injury lawyer Liverpool.” These businesses require comprehensive local SEO strategies that incorporate Google Business Profile optimisation, local citation building, and content marketing focused on legal expertise.

Accountancy practices benefit from seasonal SEO campaigns targeting tax return periods and year-end accounting services. Content strategies should address both individual and business clients, with particular focus on Liverpool’s substantial SME market.

Medical practices and healthcare providers must balance visibility requirements with regulatory compliance. SEO strategies should prioritise authoritative content that demonstrates expertise whilst adhering to medical advertising standards.

Private healthcare providers targeting Liverpool’s affluent professional demographic require sophisticated paid search campaigns complementing organic SEO efforts. Geographic targeting should extend to surrounding areas including Wirral and Chester to maximise patient acquisition opportunities.

Liverpool’s innovation ecosystem demonstrates remarkable maturity according to startup ecosystem rankings. The city ranks 9th globally for hosting a thriving startup environment. This is supported by accelerators including Baltic Ventures and networking organisations such as Startup Grind, as documented in entrepreneurship infrastructure analysis.

Tech sector funding analysis shows angel investment remains the dominant source at 67% for Liverpool’s tech businesses. 34% of entrants operate as bootstrapped businesses, showcasing entrepreneurial resilience according to startup funding surveys.

Liverpool John Moores University research on the Liverpool City Region scale-up ecosystem reveals 590 scale-up businesses currently supported. Micro and Small Sized Enterprises comprise 97.7% of the regional economy. This foundation provides a strong pipeline for business growth and expansion, creating sustained demand for professional services including digital marketing and SEO.

Liverpool City Region Local Skills Improvement Plan documentation shows evolved business support infrastructure. This addresses skills development through partnerships between chambers of commerce, colleges, and independent training providers.

This coordinated approach ensures businesses have access to skilled personnel capable of supporting growth strategies according to skills development assessments. Liverpool Chamber of Commerce plays a central role in business advocacy and networking, conducting quarterly economic surveys that inform policy decisions at local and national levels according to their policy influence documentation.

These surveys consistently demonstrate the challenges and opportunities facing Liverpool businesses. They include concerns about taxation affecting 48% of firms, inflation pressures, and investment confidence according to the latest quarterly survey results.

Professional networking opportunities abound through organisations including Professional Liverpool, Pink Link Liverpool, and sector-specific groups. These facilitate business development and partnership formation according to networking infrastructure mapping. The Liverpool Business Expo attracts 150 exhibitors and 1,800 visitors annually, demonstrating the city’s commitment to business networking and development according to event participation data.

Despite strong growth indicators, Liverpool Chamber of Commerce quarterly surveys reveal several challenges impacting market conditions. Taxation concerns have become the primary external worry for 48% of firms, up from 36% in Q2 2024 according to the latest business confidence survey.

This anxiety affects investment decisions and business expansion plans. Recruitment difficulties persist according to Chamber of Commerce labour market analysis, with 59% of Liverpool businesses attempting to recruit facing challenges. These particularly affect professional, managerial, and skilled technical roles.

This skills shortage creates opportunities for businesses that can attract and retain talent. However, it potentially constrains growth for those unable to recruit effectively.

Access to high-quality office space remains constrained according to commercial property market analysis. Fisher German experts note that “until we begin to develop and build top quality developments as seen in Manchester, Birmingham and London, we are never going to realise the rental levels that these cities enjoy.” This infrastructure challenge may limit the ability to attract large-scale national and international businesses.

The digital skills shortage particularly affects Liverpool’s growing tech sector. Software development, data analytics, and digital marketing roles remain difficult to fill according to recruitment agency analysis.

This creates opportunities for training providers and educational institutions to develop targeted programmes. It also supports higher salary expectations for qualified digital professionals, potentially attracting talent from other regions.

Commercial property developers identify several key requirements for attracting large-scale business investment. These include Grade A office space with modern amenities, sustainable building certifications, and excellent transport connectivity.

The Liverpool Waters development aims to address these requirements through mixed-use commercial and residential spaces. However, completion timelines extend into the late 2020s, potentially constraining immediate growth opportunities for businesses requiring premium office accommodation.

Liverpool’s comprehensive market intelligence reveals a city in transition, balancing traditional economic strengths with emerging digital opportunities according to economic development strategy documents. The convergence of stable economic fundamentals, growing digital sectors, and substantial infrastructure investment creates a compelling environment for business growth and expansion.

For SEO professionals and digital marketing agencies, Liverpool City Council business data showing 17,985 active businesses presents a target-rich environment requiring digital visibility strategies. Liverpool Chamber of Commerce analysis of the £36.98 billion Professional Business Services sector offers particularly attractive opportunities for agencies capable of delivering sophisticated, results-driven campaigns.

Liverpool SEO Market Analysis – Competition levels, sector opportunities, mobile dominance, and growth projections for digital marketing services

Liverpool City Region digital strategy documentation showing 52% digital sector GVA growth indicates that businesses understand the importance of digital transformation. This creates sustained demand for SEO services that can demonstrate clear ROI. Mobile usage research showing 80% search dominance necessitates agencies that prioritise mobile-first strategies and local optimisation.

Investment projections in Liverpool City Region prosperity planning, targeting £41.7 billion GVA benefit by 2030, suggest Liverpool will continue attracting businesses seeking modern, connected environments. This growth trajectory supports long-term market expansion for digital service providers according to economic development forecasting.

Property market forecasts showing 20% growth and commercial development pipeline analysis indicate that new businesses will continue locating in Liverpool. This creates ongoing demand for local SEO and digital marketing services. Rental market analysis showing 8.4% growth demonstrates strong demand for commercial space, supporting business confidence and investment.

The immediate opportunity for SEO agencies lies in serving the 12,545 Professional Business Services companies requiring enhanced digital visibility. Many of these businesses operate traditional service models and require education about digital marketing benefits and ROI potential.

E-commerce businesses represent another immediate opportunity, particularly those serving Liverpool’s growing population and visitor economy. Local retail businesses require omnichannel strategies that integrate physical and digital presence to compete with national chains and online retailers.

Foreign Direct Investment planning targeting 30% growth by 2030 suggests Liverpool will increasingly attract international businesses. These require local market expertise and digital marketing strategies tailored to UK audiences according to investment promotion strategies. This international dimension creates opportunities for agencies with global experience and local knowledge.

The FinTech sector’s projected growth, supported by £218.6 million annual GVA, presents opportunities for agencies specialising in financial services marketing. These businesses require sophisticated compliance-aware digital strategies that balance visibility with regulatory requirements.

Healthcare and life sciences companies, benefiting from Investment Zone status, will require specialised digital marketing approaches. The sector’s growth trajectory suggests sustained demand for agencies capable of navigating healthcare marketing regulations whilst delivering measurable results.

Liverpool’s combination of economic stability, digital innovation, and strategic investment positions the city as an attractive location for businesses across sectors according to comprehensive market analysis. For SEO professionals, the market offers substantial opportunities to support business growth whilst benefiting from the city’s expanding economic base and commitment to digital transformation.

Agencies should focus on developing sector-specific expertise, particularly in Professional Business Services, FinTech, and Healthcare. The ability to demonstrate deep understanding of client industries and regulatory environments will differentiate successful providers from generic digital marketing agencies.

Technical SEO capabilities will become increasingly important as Google’s algorithm updates continue emphasising user experience factors. Agencies investing in Core Web Vitals optimisation, mobile-first design, and voice search capabilities will capture greater market share as businesses recognise these requirements.

Opening hours

Monday: 09:00 - 18:00

Tuesday: 09:00 - 18:00

Wednesday: 09:00 - 18:00

Thursday: 09:00 - 18:00

Friday: 09:00 - 18:00

Company info

Graham SEO Ltd

Company No.10710878

VAT No. 349888132

Office 2, Oaktree Court Business Centre

Mill Ln, Little Neston, Ness

Cheshire, CH64 8TP

Copyright © Graham SEO Ltd 2026. All Rights Reserved